Read Write Own

Read Write Own: building the next era of the internet by Chris Dixon

Introduction

The internet is probably the most important invention of the 20th century. It transformed the world just like the steam engine, printing press, and electricity. Despite beginning as an open and permission-less network (web, email), much of the value today is captured by centralized entities like Google, Meta, and Amazon. The negative effects of these design choices are threefold:

They stifle innovation

They tax creativity

They concentrate power and money in the hands of a few

In other words, the internet has become permission-ed. Creators have to ask for permission from centralized gatekeepers to launch and grow new products. Dominant tech businesses can leverage the power of permission to thwart competition, desolate markets, and extract rents. This is especially problematic when the killer app of the internet is networks. Most of what people do online involves networks: The web and email are networks. Social apps like Instagram, Tiktok, and Twitter are networks. Payment apps like Paypal and Venmo are networks. Marketplaces like Airbnb and Uber are networks.

Amazon can learn which products in its marketplace are top sellers and undercut their makers with cheap version.

Google can use its search engine to boost the prominence of its products over its competitors.

Apple can charge high take rates to developers in the App Store. Epic, Spotify, and Tinder have filed complaints for anticompetitive rules. [1]

However, with a new technological blockchain movement emerging, the dream of an open network that fosters creativity and entrepreneurship doesn’t have to die. In this article, we will explore some of the key ideas within “Read Write Own” and how blockchains can revolutionized the internet.

History of the internet and networks

The internet today is really a “network of networks”, built up several layers from the most basic level like IP and HTTP to more abstract layers like Facebook and Twitter. Since much of the world’s data and value are recorded inside these networks, the design of these networks are extremely important. How these networks are designed determines where rights and money flow to.

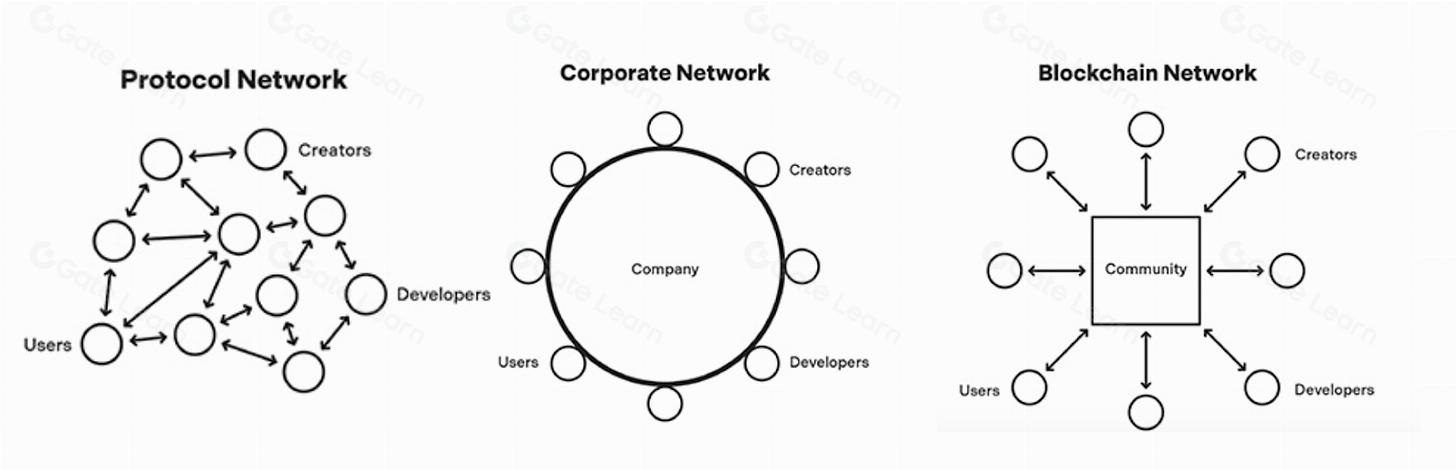

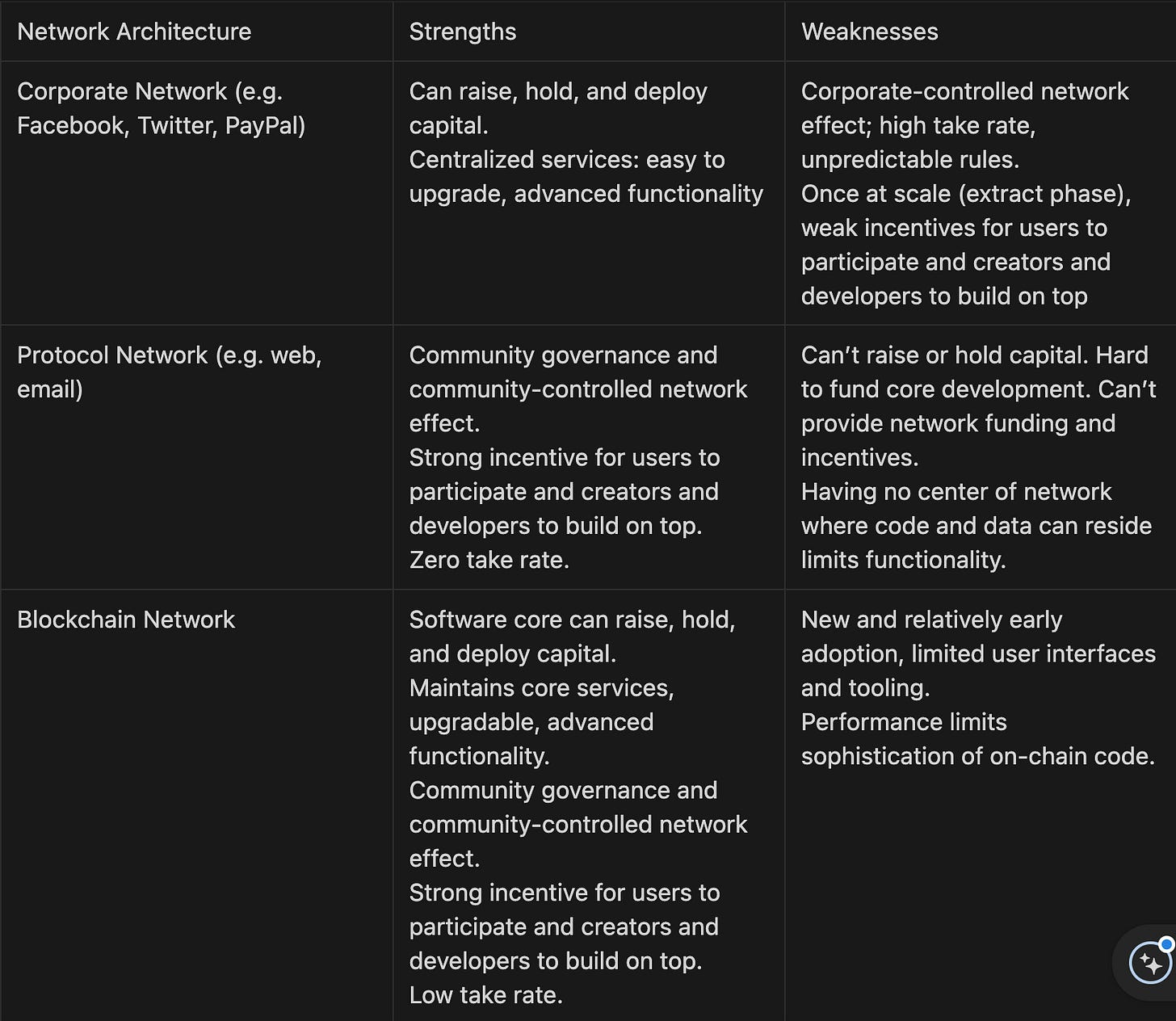

Before blockchain technology existed, there were primarily two network architectures: protocol networks and corporate networks.

Protocol networks are defined by a set of open-sourced rules of how participants can interact with each other. Examples include the web, email, DNS, and RSS. The benefits of protocol networks include

endowing users with ownership, which benefits all network participants. For instance, I own a DNS domain name and if AWS decides to shut my website down, I can still host on other cloud providers and keep my network. Whereas if I have a twitter handle and twitter decides to shut my account down, I just lost all my followers and network. The promise of ownership motivates builders and investors. When spam became an issue in the late 1990s, VCs funded dozen of startups to address the problem. Contrast with how corporate networks like Twitter are still fighting spam today. Only the company itself tries to solve it, which has a limited number of talents and resources.

network effects: they get more valuable as more people use them. The difference between email’s network effect and Twitter’s network effect is that an email’s network effect accrues to a community instead of a company.

since protocol networks have no central intermediary, they don’t charge take rates. You can confidently trust that by building on top of email and the web, you own control. This led to many great products during the 2000s. In contrast, corporate networks have high take rates and have unpredictable incentives. In 2013, Facebook removed API access from Vine, a short video app. Facebook has also cracked down on apps like BranchOut (job hunting), MessageMe (messaging), Path (social networking), Phhhoto (GIF making), and Voxer (voice chat).

Developers don’t need permission to build clients and apps on protocol networks. These networks are open, allowing the independent developer community to solve problems and develop new features.

Corporate networks are closed networks controlled by companies like Meta or Twitter. While they support APIs to support outside developers, most of their incentive is to increase profits. Thus, they have very high take rates and the majority of the value that creators, developers, and other users on the network accrue to the platform, rather than to the users themselves.

https://readwriteown.com/

The Fall of RSS

RSS is a protocol with functionality similar to a social network. It lets you make list of users you want to follow, and it allows those users to send you content. In the 2000s, RSS was a credible competitor to Twitter and Facebook. But by 2009, people were relying on Twitter more while the RSS community thought Twitter was just a popular node (frontend application) in the network. No one worried because Twitter had an open API and stated commitment to interoperate with RSS. In 2013, Twitter stopped supporting RSS as soon as its corporate goals were achieved and RSS has fallen way behind. Two main reasons RSS lost:

RSS couldn’t match the ease of use and advanced functionality of corporate networks.

Funding. For-profit companies can raise from VC to hire more devs and build advanced functionalities.

Problem with corporate networks: attract-extract cycle

What’s a hot dog without its bun, or an iPhone without apps? More value for one complement means less for the other. Social networks often promote a content creator to get more audience on the platform only then to adjust the algorithm so the creators no longer receive the same levels of attention organically (then force creators to buy sponsored posts). First step is to attract users and the next is to extract value from them.

Blockchain networks

Quick summary on blockchains

State machines are the purest way to think about a computer. You have states, a place to store information, and transitions, a means to modify that information.

Blockchains are by design resilient to manipulation. They are built on top of a network of physical computers that anyone can join but extremely difficult for one entity to control. These computers store states and “validators” validate state transitions.

Imagine a large spread sheet that stores the account balance of users and is public to everyone. If a new user joins the network, how can people agree on the new state of the spread sheet? Validators verify that every transaction has a valid digital signature, and validators are picked by commitment (e.g. Proof of work or proof of stake) to reach consensus.

State transitions can be more than a spreadsheet. It can support code, smart contracts, marketplaces, metaverses, and other blockchains. Blockchains are a new type of computer.

Why blockchains matter?

Democratic. Provides an equal opportunity for everyone to participate like the early internet.

Transparent. The complete history of the code and data is publicly available.

Blockchains can make strong commitments about their future behavior. Traditional computers can’t make commitments like these because they are controlled by individuals or groups of people. All they do is put a “term of service” which no one reads and can change at any time. Blockchains invert the relationship because they put the code in charge. Software is in charge instead of hardware.

If Google made a coin called GoogleCoin with 21 million supply, you will never trust them because their commitments are weak. However, you will trust that Bitcoin has 21 million supply.

Blockchains are the most useful in large multi-player environments where people don’t have preexisting relationships and have not been so successful in corporate organizations (enterprise blockchains).

Tokens

Tokens represent ownership in the digital world (e.g. a game item in League of Legends). Fungible tokens are interchangeable (e.g. Bitcoin, apples to apples). Non-fungible tokens NFTs are unique.

A city is great because it has a mix of public and private spaces. Public spaces attract visitors and improve daily life. Private spaces create incentives for people to build businesses and adding essential services. The internet should be the same. Before blockchains, network architectures were limited because one must assume that any software acting as a network node can potentially “turn evil”. Historically, only protocol networks and corporate networks have worked. Blockchains can completely change the design.

Blockchain functions have neat analogues in urban planning. Starting a blockchain network is like building a new city on undeveloped land. The city designer constructs some initial buildings. Property rights — ownership — play a key role, providing strong commitments that property owners will get to keep what they own and can feel comfortable investing in it. As the city grows, so does the tax base. Taxes are reinvested into public projects like streets and parks.

Just like blockchains, tokens confer ownership and network fees are like city taxes.

As an entrepreneur, you want to understand the rules of the city like are they predictable, are taxes reasonable, will any rule change follow a fair process, will you get financial upside? Fairness and predictability encourage you to invest your time and money. Your success and the city’s success are mutually dependent. These considerations are the same in a blockchain network.

Tokenomics

Open-sourcing software is powerful because it promotes composability, which is like lego bricks for software. Composability provides two benefits:

Encapsulation - one person can create a software and the other can use it, without worrying about the underlying details.

Reusability - every component is only created once and can be continuously reused.

So far, open sourced software is mainly just code sitting in repositories as opposed to services which code is run in. This is because hosting costs money and most open source contributors do not have money.

Meanwhile, corporate APIs can host, and that provides nice encapsulation but not reusability. They do not benefit from the crowded-sourced wisdom and do not contribute to the global knowledge database. Furthermore, they can tighten their grip anytime and limit the use of these APIs.

Blockchains solve this since they provide strong commitments about the future. Second, blockchains like Ethereum fund hosting expenses through sustainable models using tokens. As long as there are demand for Ethereum, users and developers will pay gas fees that power the validators.

Take Rates

When centralized networks become more powerful and enter the extract phase, their take rates increase and squeeze every drop of value out of consumers.

Blockchain networks offer lower take rates. Ideally, it should be high enough to cover network fees and low enough to create a bureaucratic bloat. An argument against this is that the low take rates are just temporary. Just like RSS, someone will build an app on the blockchain that will attract all the users. Blockchains can avoid this if it is well designed:

Low-friction user experiences that match those of modern corporate networks

Network effects that accrue to community-controlled blockchains rather than to company-controlled front-end applications.

OpenSea is a corporate-owned application but since the NFTs and tokens are in the user’s hand, they can’t have high take rates. Otherwise, users would just switch to another marketplace.

Squeezing the balloon

When one layer in a “tech stack” becomes commoditized, another layer becomes more profitable. It’s common for a tech stack to become commoditized when products and services are (1) given away for free, like Calculator app on iPhone. (2) made open source, like Linux. (3) controlled by a community, like the email protocol SMTP. The overall market can grow or shrink, but competition between layers is zero-sum.

Google Search makes money when a user clicks an ad. In between advertiser paying and user clicks, technologies intervene: a device like a phone, an operating system, a web browser, a telecom carrier, a search engine, an ad network. Google’s strategy with respect to search is to either own or commoditize the layers in the stack to maximize its own revenue. Google created devices (pixels), OS (android), browsers (Chrome + Chromium), carrier services (GoogleFi). It’s doing so to boost search profits. Google pays Apple $12 billion per year for Google to remain as the iPhone’s default search engine. If Android didn’t exist, the cost would be much higher.

Another example is Intel supporting Linux to boost its moneymaking processors.

The logic can be applied to social networks. If you want to build a network that encourages creativity and innovation, you can’t squeeze the profits out of the consumers (thick). You need to squeeze it at the core (thin). The web started as a thin network (HTTP) and has led to explosive innovation in the last 30 years. It’s currently been squeezed in the wrong direction that stifles innovation.

The same can be applied to financial networks: there are currently very profitable payments companies and new startups/VC are lured by the high take rates. However, we have the technology to make financial infra a public good. DeFi makes payments/lending/trading thin.

Token Incentives

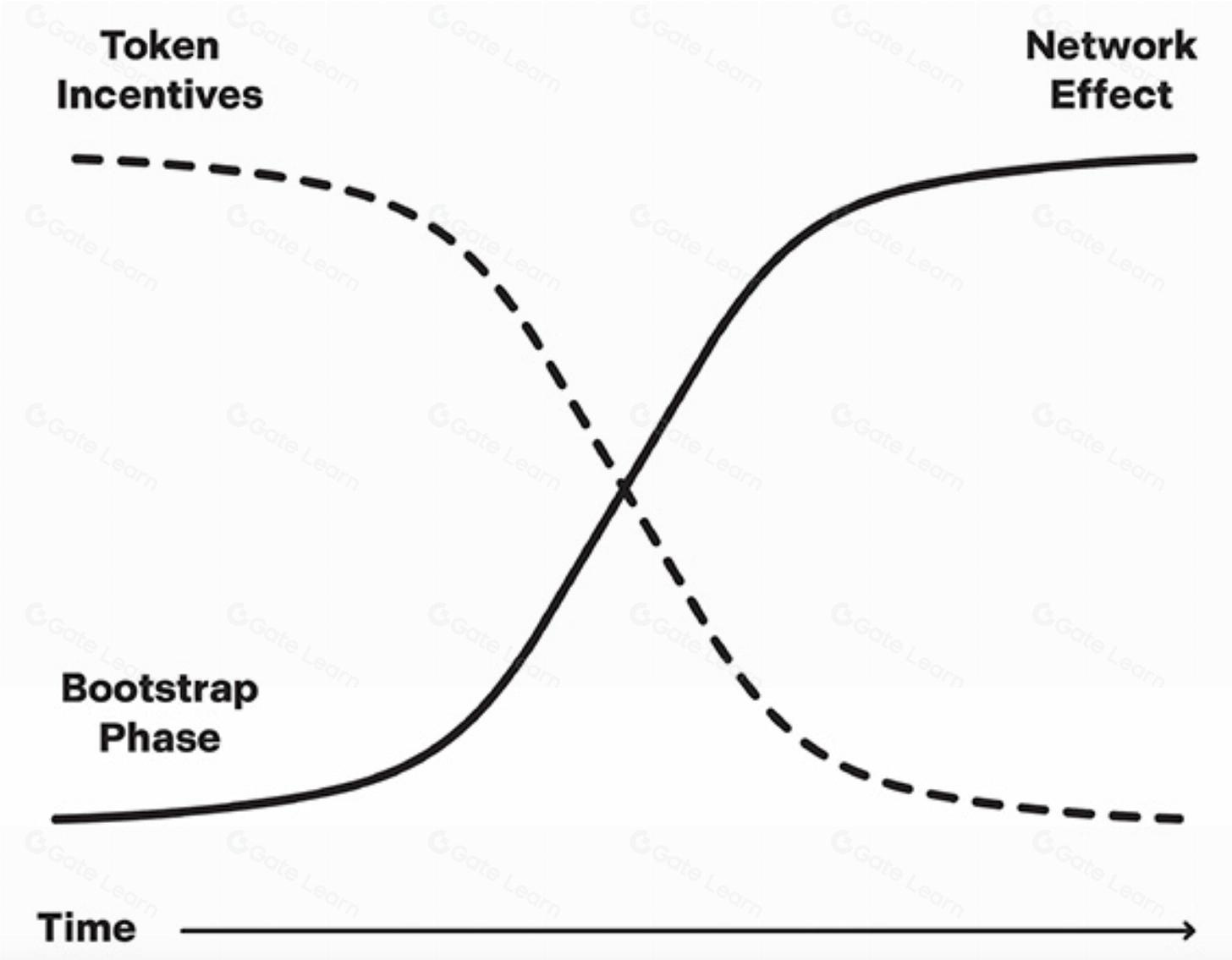

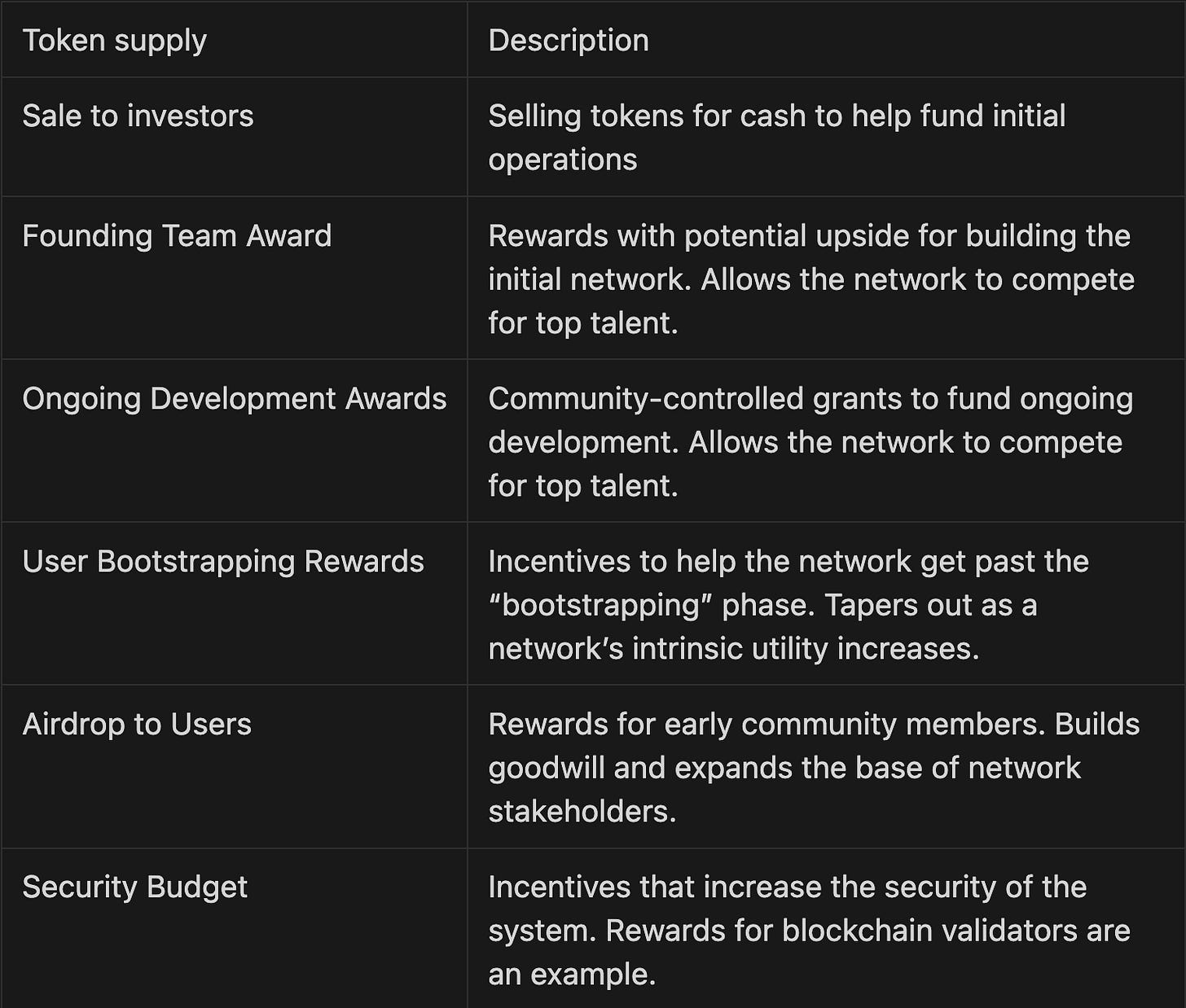

So far everything sounds ideal, but why would a developer want to build on a blockchain network when corporate networks pay more? In a well-designed blockchain network, tokens can be used as an incentive to attract developers, and ownership of the tokens turn them into stakeholders.

Tokens help overcome the bootstrap problem: network effects don’t benefit for small networks.

https://readwriteown.com/

Tokens are self-marketing: Bitcoin, Ethereum, Dogecoin

Tokenomics

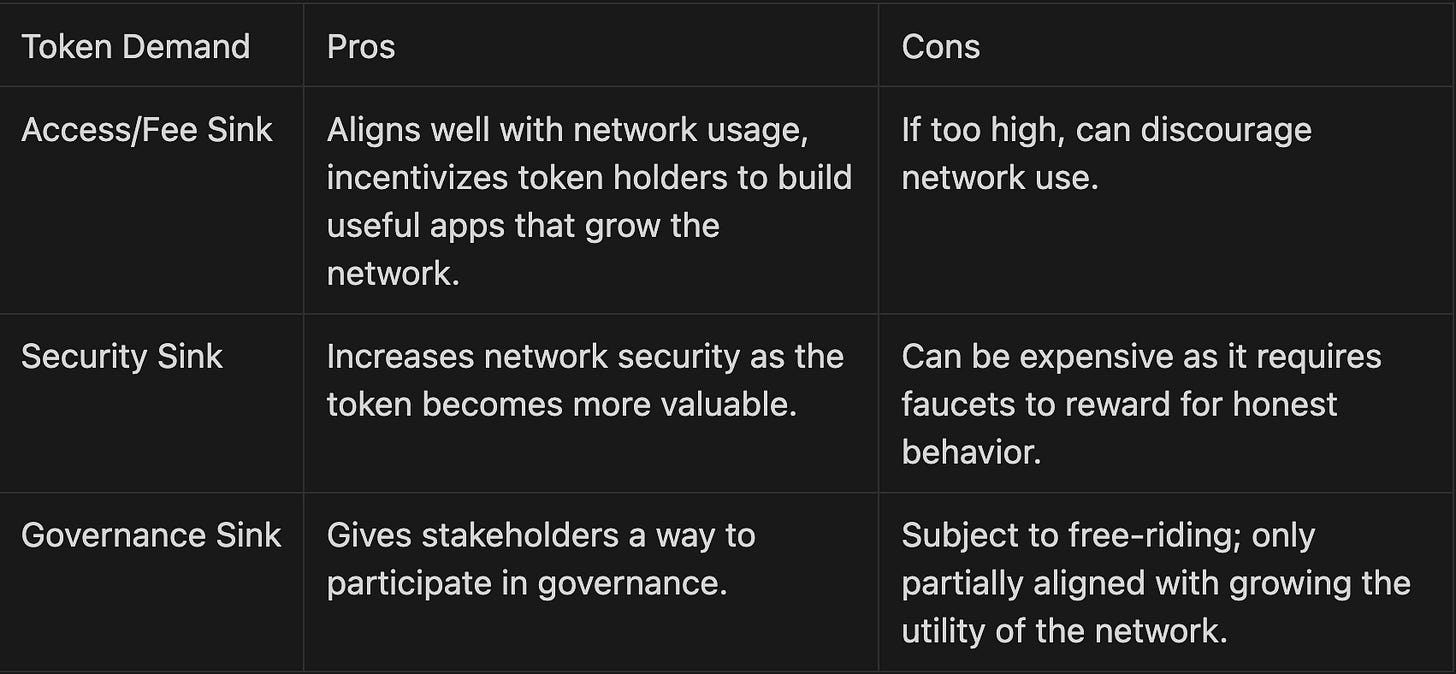

“Designing systems of incentives to underpin blockchain networks”

Like any virtual economy, it should balance the supply and demand of native tokens to fuel sustainable growth.

Speculation exists everywhere property can be bought or sold and blockchains have already gone through multiple boom-bust cycles. But in the long run, people will value new technologies based on fundamentals.

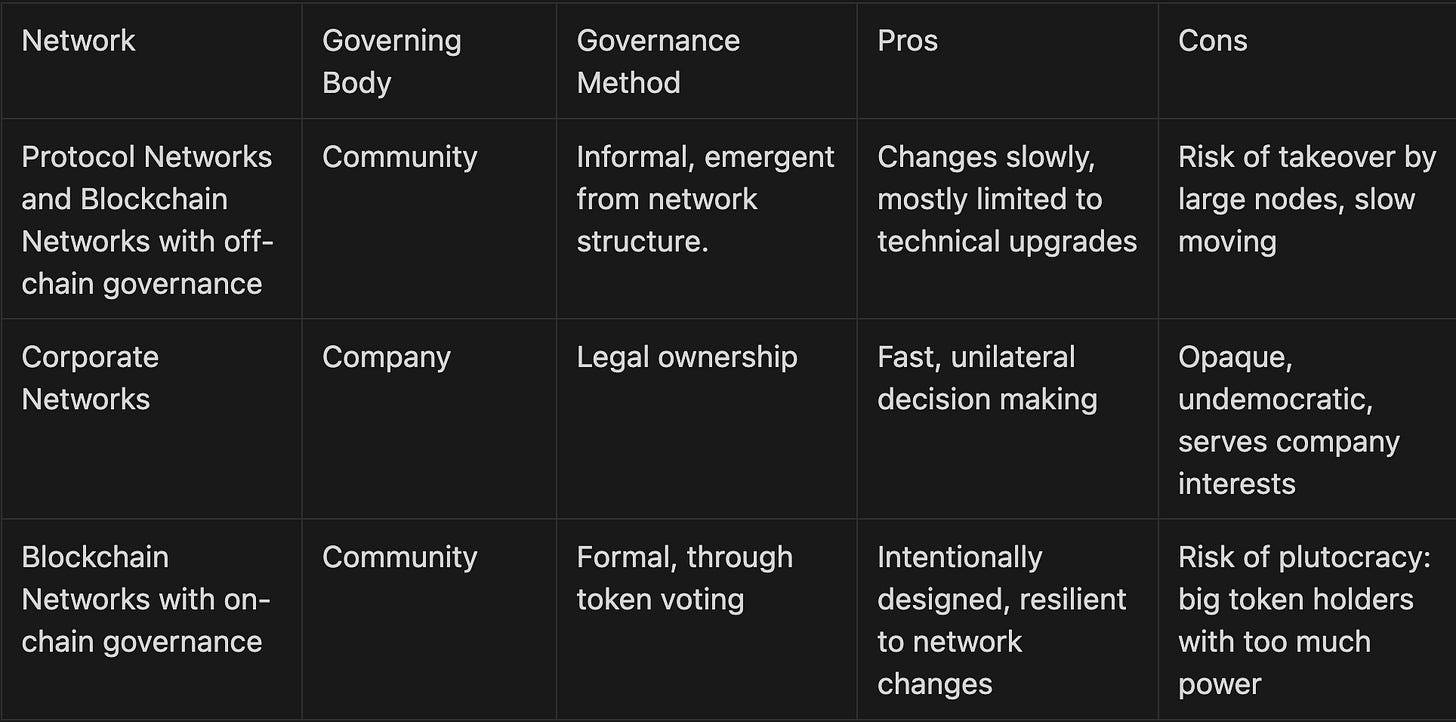

Network Governance

Most of today’s popular internet products are governed by dictatorship, and a growing number of people are coming around to the idea that networks are too important to leave to the whims of single, powerful companies or individuals.

Some people believe nonprofit models provide a solution (e.g. Wikipedia). However, Wikipedia has relatively low support cost and thus cannot be replicated to other domains. Mozilla and OpenAI have both started as nonprofit models but later pivoted away to for-profit.

Others believe federated networked — many dictators on many servers — will solve the centralized issue. However, federated networks do not provide smooth UI experiences because data is located across multiple non-related servers. Also, when one server gets more popular, it will be forced to become a corporate network. Similar to RSS and Twitter.

Network designers can use blockchains to create formal rules that are enforced by code. These rules are like constitutions for networks. What these constitutions say is subject to debate, contention, and experimentation, but their very existence, the ability to enshrine rules in immutable software, is a meaningful advance that was not possible in previous network designs.

The Computer and the Casino

Crypto can be characterized as two distinct cultures: the computer and the casino.

The computer culture represents the developers, entrepreneurs, and visionaries that focus on the technological aspect of blockchains. The casino culture represents the group of people that try to profit on the short term fluctuations of the market.

Unfortunately, the term “crypto” and “tokens” today lead to the thinking of casino culture. Bad actors like Do Kwon (Terra founder), and Sam Bankman-Fried (FTX founder) use the technology to perpetuate fraud, which obscures real technological advancements in the space.

It is with our hopes that increased regulations in the area can decrease the harmful effects of the casino culture.

Regulation

Securities are assets where pockets of information exists that are accessible to some people but not to others. Regulators aim to reduce information asymmetries.

Commodities are assets where information is uniformly accessible.

If tokens are classified as securities, it will raise a host of issues and hurdles when transacting. E.g. you would generally need to transact through registered brokers and exchanges, making the technology centralized again. Just imagine every time you want to interact with a web3 app you would have to transact through brokers and exchanges like a stock.

Blockchains can only compete with corporate networks if they eliminate friction.

Both regulators and blockchain networks have one common philosophical goal: eliminate the need for trust. It’s just regulators do so by regulation and blockchains do so by the technology.

Regulators generally agree that if a Blockchain is “mostly decentralized”, it can be classified as a commodity (Bitcoin).

Howey test for deciding if what constitutes as an security

an investment of money

in a common enterprise

with a reasonable expectation of profit to be derived from the efforts of others

Being in the gray area is bad because it allows bad actors to quickly launch tokens and grow while leaving good actors that spend on lawyers to create “sufficient decentralization” at a disadvantage. The main debate today is whether digital assets should be subjected to additional rules traditionally reserved for assets classified as securities.

Future of Blockchains

It takes years, decades even, for new computing platforms to go from prototype to mainstream adoption. This is true for hardware like PC, mobile phones, and VR headsets. It is also true for software systems like blockchains and AI.

In 2007, people wondered what kinds of mobile apps would matter? Now, people should think what kinds of blockchain networks matter. Two areas are social networks and financial networks because they have taken off from PC → Mobile, and can be successful in blockchains.

As more of the economy move online, so will jobs. Graphics and visualization will get so good that one day it will enable the Metaverse.

Tim Sweeney, the founder of Epic, describe his vision of an open metaverse…

We need a file format for representing the 3D world. A protocol for changing it, like HTTPS. A means of performing secure commerce, which could be the blockchain. A realtime protocol for sending and receiving positions of objects in the world and facial motion.

But blockchains don’t have to be limited to just commerce. They can after all replace any networks. If the Metaverse was closed, we could end up with a dystopia like the movie Ready Player One.

NFTs: Scarce value in an Era of Abundance

Copying is both good and bad for creators. One the one hand, it distributes creative work to a wide audience. On the other hand, the abundance of media creates heated competition for attention.

Scarcity can convert attention into money, but scarcity also prevents media from benefiting from the supercharged copying machine that is the internet. Attention-monetization dilemma — the trade-off media creators face between maximizing attention and maximizing money.

The gaming industry is far ahead of other medias in navigating this dilemma since games tend to have short lives and must adapt to change. Gaming went from charging money per game → giving certain levels out free → pay to win → completely free but with virtual goods. Today, games like Fortnite, League of Legends, and Clash Royale come bundled with streaming and virtual goods, a good mix of attention-monetization. Game studios shrank one part of the revenue balloon while inflating other parts.

In contrast, the music industry filed lawsuits against internet innovators and focused less on expanding new businesses. It’s not that the demand for music is less (if more than anything it should be more now), it’s the hurdles to create music-related businesses. Every year, there are many gaming startups but rarely music startups.

What virtual goods did for video games, NFTs can do for other forms of internet media: a new layer of value — digital ownership. Think of buying an NFT as buying an official product from a brand. The rise of generative AI will also make copyright model harder to sustain.

AI: a new economic covenant for creators

The internet operates on an implicit economic covenant. Creators bring supply, and distributors bring demand. In modern internet, Google brings webpages that were created by content providers. Since there are much more creators than distributors, Google has a huge power to charge creators more in order to rank them higher.

Google has this one-box feature, where when a user searches something, Google will give them the answer, without having them to click into any links. Although small, it is a nightmare for any startup that can’t afford such advantage. Creators that choose to opt out of this system will also be left out, since they will receive no traffic.

Looking into modern day system, ChatGPT is basically the one-box feature on the entire internet. There’s no reason for users to have to manually search for results when they can get it in one stop.

Meanwhile, systems like ChatGPT take creator content and train on it, then show it to other people. There’s zero incentive given to creators. Thus, why should creators still create content in the future?

There are three scenarios

Content creators stop creation and remove their work, which stops AI progress.

AI systems fund their own content creation (content farms), but this seems depressing since machines direct progress while humans toil like cogs.

A better way would be to develop a new economic relation between creators and suppliers. But creators by themselves are often weak and have no coordination.

Blockchains are perfect for solving large scale economic coordination problems.

Deepfakes

Most open-sourced models these days can generate very convincing deep fakes, so there needs to be a way to combat this. Blockchain attestation could solve the issue. Essentially, I can digitally sign a picture saying I created it. Another media company could add to that attestation by signing another transaction. Users could also tie themselves to blockchain-based naming services.

The advantages of storing media attestations on blockchains are threefold.

Transparent and immutable audit trails: anyone can examine the full content and history.

Credible neutrality: If a company controlled the attestation database, it could leverage this control to restrict or charge access.

Composability: social networks can integrate the attestations. An ecosystem of apps and services could develop around it.

Thoughts on the book

Web3 is an ideological revolution powered by technological revolution. This is because it focuses on shifting value from the core of the network to the edges of the network, enabling a trust-less and permanence environment using blockchains. While the technological transition is challenging, I think the philosophical idea of web3 is even further away.

Before reading the book, some of my biggest doubts about web3 are

If corporate networks have better access to funding, why would developers be incentivized to build on decentralized blockchains?

Is the concept of digital ownership that important to the average user?

For question 1, the author argues token incentives can be created to incentivize early adopters and users. If the token economics are well-designed enough, then that will be a source of funding. But how these tokenomics should be designed wasn’t discussed in the book, particularly because there have not been successful cases of well-designed tokenomics yet. In fact, there are numerous examples of failed tokenomics where founders control a huge portion of the tokens and dump on investors.

Currently, most crypto projects incentivize early adopters by airdrops, but airdrops are highly speculative and I do think most people do not hold these tokens for long. For the average developer, it just doesn’t make much sense to be working for a project that pays you speculative coins when you can work at web2 companies for stable pay. Furthermore, it doesn’t make much sense to me to build something now only to give up ownership and control later to the token holders (which are mostly VCs and thus still leaving important networks in the hands of few people).

Every blockchain project starts off as a “centralized organization” to attract funding and develop. Then, after reaching a certain point, it should give the governance power to the token holders in order to stay decentralized. But this transition is difficult. Chris Dixon says that blockchains are immutable, offer “strong-commitments”, allow software to be in control of hardware, and allow people to reach consensus. This is true to an extent but overlooks the fact that the original founders and developers do often change the code and still own control. A look at these projects would explain how unsuccessful DAOs and decentralized governance have been and in the end are still centralized because they want control/ownership.

To me, this seems more of a economic problem than a technological barrier since it is technologically decentralized but fundamentally centralized.

Another interesting concept in the book is data ownership. Essentially, applications can be controlled by the company but any data online should be owned by you and theoretically tokenized, whether that’s your internet handle, social posts, or in game items. It will be public because it is on the blockchain but anonymized to preserve privacy. But this brings me to the second question: is data ownership important to the average user? In the book, Chris Dixon mainly talks about the problems of the attract-extract model and perhaps getting your Twitter handle revoked like Donald Trump. But this doesn’t apply to 90% of the users.

Furthermore, data is the moat for most companies. Just imagine if Tesla followed the Web3 approach and gave users control of their own camera data. One day the customers/shareholders end up not liking the design of the car, so they decide to move their camera data onto another car manufacture's blockchain. Now instantly another car company can replicate the self-driving technology using the data. As an investor, why would I invest in such company without a strong moat?

Regardless, the book still has many good points. Chris Dixon did make a really good point that the internet is heading in the wrong direction since the internet started out decentralized and is now concentrated in the hands of a few people that just apply the attract-extract model. Creators are not getting enough benefits on the network though they are arguably very important to the network. While the attract-extract model is problematic for network participants, it is unrealistic to think any founder would not extract it in the long run even if they started out with a non-profit goal. I do think blockchains could provide a right step towards solving this issue but right now the technology is still too new and we have not seen good solutions been proposed. Second, considering how many startups big tech have bullied since the early 2010s without facing much consequences shows how the issue isn’t a priority to many.

Perhaps, the best world will be a mix of Web2 and Web3 applications. After all, blockchains decouple the data layer from the application layer, and this design works the best in environments where you have a lot of multiplayers in a trustless environment. If you think about it then certain infrastructures like finance and the metaverse can benefit the most from blockchain designs.

Web3 enables trust and freedom in the digital world, and we are just in the beginnings of this new technology.